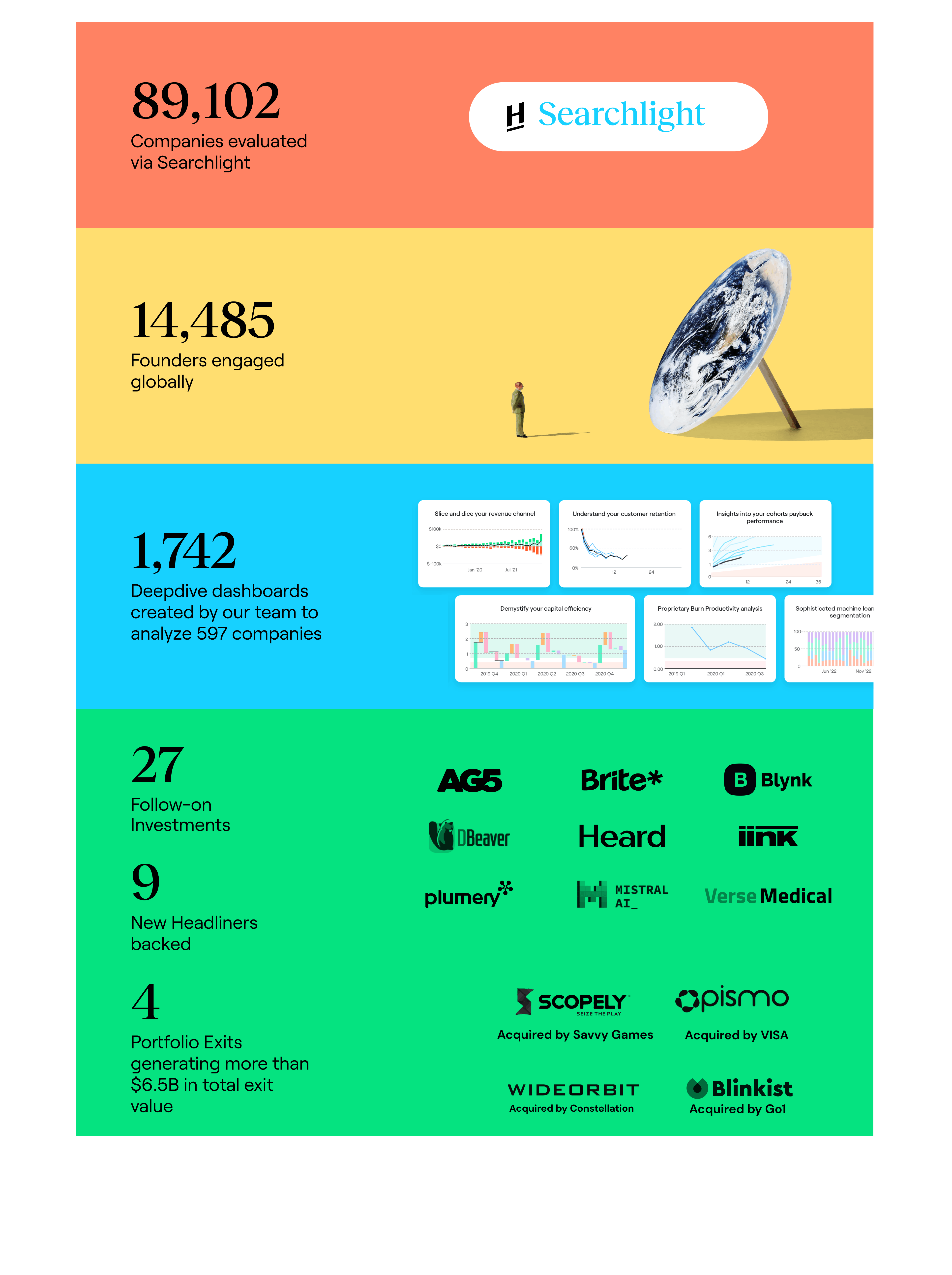

As we approach the end of 2023, we’re reflecting on the trends that permeated the startup world, informed by our team’s unique bird's-eye view of the ecosystem. In 2023, Headline’s investment teams evaluated more than 89,000 companies via our proprietary data-driven sourcing platform, Searchlight. Through Searchlight and our unprecedented volume of company engagement, we’re able to spot and track fast growing startups wherever they are in the world, at any stage of development. In the past, this led to Headline’s early investments into now global category leaders such as Bitwarden, The RealReal, SEMRush and Segment, all sourced through Searchlight. Our exposure also allows us to extract trends across the startup landscape given the breadth of our engagement.

This year, Headline invested in 9 new early stage companies across the US and Europe and doubled down on existing founders with 27 follow-on investments. At the same time, Headline portfolio companies Pismo, Scopely, WideOrbit, and Blinkist generated more than $6.5B in total exited enterprise value.

Let’s dive into some of the notable trends we observed from our conversations with thousands of early stage founders this year and what we can learn from them heading into 2024.

Macro Insights

Of the 89,000 companies we evaluated globally this year, our team spoke with more than 14,000 founders across the consumer, fintech, infrastructure and B2B software sectors. We learned a good deal about the trends driving innovation in early stage companies, the challenges facing founders in this fundraising environment, and the overall health of the recent cohort of newly created technology companies.

Here are the four key macro trends we observed:

- An overall reduction in spend across sectors and stages, with impact based on a given company’s retention dynamics.

- A rapid spike in growth within the development of AI and AI-supported products. However, sustainable long-term value creation and retention along the value chain is yet to be determined.

- Suppressed demand for traditional product managers and heightened need for technical product leaders. .

- A meaningful bifurcation in capital allocation within the venture-backed startup ecosystem, driven by a combination of risk-off reflexes and a time-pressured need to deploy investment capital into high growth assets.

I. Reduction In Spend → Mixed Results on Efficiency

In 2023, we observed a couple of notable shifts in capital efficiency thanks to our analysis of nearly 600 companies in our in-house built (and now public) business intelligence platform, Deepdive. The most prevalent trend has been the significant reduction in below-the-line expenditures (all fixed costs). This pullback is especially evident for companies that have raised over $10 million in capital, with very few opting to expand their budgets. We see this as a direct result of increased interest rates increasing the cost of capital both in the US and globally over the last 18 months.

This fiscal conservatism has also led to a reduction in sales and marketing budgets, which, for many companies, reduced the cost of acquiring new customers (CAC). However, this is coupled with a slowdown in acquiring new customers and the revenue they bring. We noticed that this trend impacts companies differently depending on their retention dynamics. For those with strong customer and revenue retention, it translates to slower top-line growth. For those with weaker retention, it often results in stagnation, if not even a reduction in top-line traction, as they are unable to offset churn with new customer acquisition.

Despite the decrease in expenses, many businesses have not seen improvements in fundamental capital efficiency (annualized gross profit growth for every dollar burned) or burn productivity (the cost for every dollar of net growth). The decline in top-line growth often outpaces the reduction in cash burn, maintaining neutral levels of growth per dollar burned. At Headline, we have seen this as a turning-the-scope moment, where only exceptional teams with great products can successfully cut expenses at a greater rate than their top-line growth.

In our sub-sector of VC-backed start-ups, we see these trends strongly encouraged by venture capital investors who, with renewed vigor, emphasize strong financial metrics. As the cost of capital remains high, we believe this hawkishness will persist into the coming year, with strong metrics remaining a key ingredient to demand premium valuations at the Series A and beyond.

II. Growth in AI → Unclear Accrual of Enterprise Value

One clear trend we all saw in 2023 was the generative AI boom. We specifically evaluated the performance of these companies based on end user activity or customer-level retention. It’s important to note that these companies have shown rapid adoption and acceleration of user activity; however, the majority of the 800+ generative AI companies we spoke to this year have what we call non-asymptotic retention, meaning that the retention across customer cohorts trends towards 0%.

Put simply, customers of these early-stage generative AI companies churn at a high rate over time. This suggests that while generative AI has successfully captured widespread attention across various sectors, including B2B and B2C, only some products deliver repeatable, long-term value to their users. This trend highlights the hype surrounding generative AI this year, pointing to its initial appeal but also to its challenges in creating sustainable value within the tooling and applications layers. Today, it appears that hyperscaler incumbents (Google, Azure, AWS) who own the back end of the stack in addition to the foundational model providers are in a stronger place to capture value in the Gen-AI race than many upstarts looking to compete with them downstream (albeit in a less capital efficient manner).

III. Waning Demand for PMs → Heightened Need for Technical Product Leaders

The demand for traditional product managers in software appears to be waning, giving rise to a heightened need for technical leaders who can effectuate real product innovation. This shift is driven by a variety of factors, including the growing complexity of software sales and evolving customer needs, the oversupply of technical products in the market necessitating true differentiation, and the speed at which companies must ship in order to compete. Technical product leaders are uniquely positioned to bridge the gap between development teams and business strategies, and can be critical to helping early stage companies bring their innovations to market quickly in a world where incumbents move more slowly. This trend reflects a broader transformation in the startup landscape, where technical acumen has become as crucial as traditional business and GTM skills in driving product success.

Within our portfolio as well as across the cohort of companies we have evaluated, we have found that an overwhelming majority of startups are de-emphasizing hiring needs within traditional product roles and looking for more engineers who can sell and lead product strategy. At the same time, it appears the supply of this profile is fairly low, which creates expensive tradeoffs for companies as they compete for scarce resources.

IV. Higher Risk Market → Bifurcation of Capital Allocation

As software startups continue to evolve through a tumultuous macroeconomic environment, we have observed a parting of the seas within venture capital funding more broadly. This is driven by a tremendous amount of value dislocation due to declining revenue growth and endurance. As a consequence, investors are now prescribing - for some startups - lower median valuations at the Series A and Series B stages as well as downrounds, which have reset expectations and led to a ripple effect of lower pricing as companies evolve.

That being said, this trend has illuminated a smaller subset of high momentum startups - those that were insulated from weakening growth endurance - that investors are still clamoring to back with a large degree of price insensitivity. With a lower supply of startups demonstrating outlier growth, investors are still willing to pay 2021 prices and valuation multiples for scarcity of access to the highest performers. We see more founders raise at reasonable valuations compared to 2021, but there still remains a significant amount of dry powder that VCs need to deploy, which leads to continued over-competition and price inelasticity.

Key Takeaways

The 2023 startup landscape has been both challenging and exciting for founders, investors, and operators alike. The year presented a stark increase in interest rates, a dropoff in demand for software products, a step-change in innovation fueled by the power of machine learning, a narrowly-avoided financial crisis, and a prolonged dearth of technical talent - all of which have pushed startups to react nimbly. We have been privileged to partner with founders across the consumer, infrastructure, B2B SaaS, and fintech sectors this year. Despite market volatility, many have shown admirable resilience. Companies have adapted by reducing below-the-line budgets, prioritizing more technical talent and leadership to drive product innovation, and engaging with the platform shift toward AI.

Increased volatility and a more challenging software sales environment have noticeably made it more difficult for startups to grow revenue and scale into their 2021 valuations, so we have begun to witness a discernible dichotomy of value pricing vs. premium pricing for startups within the ecosystem.

Looking ahead to 2024, we anticipate a year of continued uncertainty where growth will be elusive. However, we fully expect AI to push the limits of every software stack as well as the speed of product innovation and operational efficiencies that can give startups more leverage. Here at Headline, we don’t fear uncertainty. With 25 years of experience investing in Early Stage startups, our team is eager to spend another new year identifying impactful products built by talented operators.